We have written in the past about Findur’s instrument Payment Calculators, a powerful licensable extension. For Openlink Findur/Endur users without the license to create a payment calculator extension, the Payment Formula feature is the only route available to handle complex instrument calculations.

This note covers the basics of instrument configuration, when it is likely necessary to enter the world of a payment formula, and a new feature Openlink made available in the February 2023 release of version 22+.

Instrument Configuration

Openlink’s instrument model has powerful features that can handle a lot of complex modeling out-of-the box. There is a long list of fields to handle many common instrument features, as well as some obscure ones. These fields are available to fungible instruments or, as Openlink terms them, ‘shared’ instruments, as well as OTC or ‘unique’ instruments.

Users facing complex instrument modeling requirements should take the time necessary to ensure there are no out-of-the-box ways to configure an instrument using the standard fields before resorting to the use of a payment formula.

Openlink’s instrument model has fields available at the instrument level and, for multi-leg instruments, at the leg level. Some complex requirements can be resolved by adding one or more legs. Other requirements can be resolved by overriding fields at the calculation period level, known to Openlink as ‘profile’ fields. It is rarely necessary, but users can even override individual resets that drive a floating rate leg. The Hybrid and HybridNote toolsets are other routes available to model highly structured instruments.

Payment Formulas

Openlink has made payment formulas available to both fungible and OTC instruments for several decades, so these features are not new. Formulas are complex to write, requiring moderately-advanced technical capabilities to implement. Often there is an iterative approach taken to enter a formula, recalculate the payments, modify the formula, and repeat until it matches the expected results.

Openlink has documentation on payment formulas, but it is not particularly high quality. We had much more to say about the complexity of payment formulas in our hagiographic post on payment calculators.

A Recent Enhancement for Fungible Instruments

We recently saw the details of an enhancement Openlink made to payment formulas for fungible instruments in Findur version 22. But before we describe that enhancement, we must first describe a layer of complexity sometimes required to model a fungible instrument.

When an analyst needs to model a bond in Findur, there are three key requirements to resolve:

- Settlement interest;

- Daily interest accrual; and

- Coupon interest.

Prior to version 22, a payment formula entered on a bond would control the results of requirements #2 and #3 above. The payment formula did not affect the settlement accrued interest. To get the settlement accrued interest correct, the user needed to correctly set the standard fields on the instrument (and leg, profile and reset, if applicable).

In version 22, a change was made to calculate #1, #2 and #3 using the payment formula. While this seems like an uncontroversial enhancement, arguably even a bug fix, the real world is often more complex. There are bonds for which the settlement interest follows a different convention to the daily interest accrual and the coupon interest. This ‘uncontroversial enhancement’ in version 22 led to reports from users of a new bug.

We have good news to share that unless you were paying close attention to the February 2023 mainenance release notes, you would have missed. An additional enhancement to this several-decade old payment formula feature was added in version 22.

Figure 1: Blink and you will miss it: the release note of the fix to the ‘uncontroversial enhancement’.

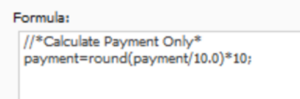

As a user, if you find a need to model a bond that has a different convention to calculate the settlement interest and the daily accrued and the coupon, you can now control this behavior. Use the magic expression //*Calculate Payment Only* at the start of the payment formula and Findur will apply the formula to daily accrued interest simulation results and the coupon payment, and will suppress the formula when calculating the settlement interest on a transaction.

Help is Out There

We pay careful attention to the details, even down to the fine print in the release notes. We share details with our clients of upgrade quality, IBOR transition, test automation, and other important work we perform to make Findur users’ lives easier. If you find yourself reaching for a payment formula, reach out! Perhaps you do not need a payment formula because the configuration is available out-of-the-box. And if you are struggling with a payment formula (sometimes we do too!) then we might have solved that puzzle before and have a solution close to hand.